Credit Score for Mortgage Approval: What Lenders Look For

Starting our journey to homeownership, we must focus on our credit score. This three-digit number is key to getting a mortgage loan. Lenders closely check our credit scores to decide if we qualify.

Whether you're buying your first home or have done it before, your mortgage credit score matters a lot. We'll look into how credit scores affect mortgage approval. We'll also learn what scores lenders need and how to boost yours before applying.

Knowing about credit scores helps us confidently find the right mortgage. It ensures we get good loan terms and low interest rates. Let's explore how a single number can change our path to owning a home.

- Understanding How Mortgage Lenders Evaluate Credit Scores

- Minimum Credit Score Requirements by Loan Type

- Credit Score for Mortgage: Key Factors That Shape Your Score

- The Role of Credit Scores in Interest Rate Determination

- Government-Backed Loans vs Conventional Mortgages: Credit Requirements

- Strategies to Improve Your Credit Score Before Applying

- Beyond Credit Scores: Additional Mortgage Approval Factors

- The Impact of Multiple Credit Inquiries During Mortgage Shopping

- Documentation Required for Credit Score Verification

- Maintaining Good Credit After Mortgage Approval

Understanding How Mortgage Lenders Evaluate Credit Scores

Getting a mortgage? Knowing how lenders check your credit scores is key. They look at scores from Equifax, Experian, and TransUnion. For one person, they use the middle score. For two or more, they look at the lowest score.

For loans backed by Fannie Mae, lenders might average the scores. This gives a better view of the borrowers' credit.

The Three Major Credit Bureaus

Equifax, Experian, and TransUnion collect and keep credit reports. Lenders use these reports to figure out credit scores. They also look at other financial info.

How Middle Credit Score is Calculated

Lenders often pick the middle score for mortgage checks. They take the highest and lowest scores and pick the middle one. This helps give a fair view of the borrower's credit and responsibility.

Impact of Multiple Borrowers

With more than one borrower, lenders use the lowest score. This makes sure the credit profile is strong enough. It meets the lender's credit report evaluation and mortgage lender credit assessment needs.

| Loan Type | Minimum Credit Score |

|---|---|

| Conventional Loan | 620 |

| FHA Loan (3.5% down payment) | 580 |

| FHA Loan (10% down payment) | 500 - 579 |

| VA Loan | No industry-standard credit score requirement (Rocket Mortgage® requires a 580 median credit score.) |

| USDA Loan | No industry-standard credit score requirement (Most lenders require a 640 score.) |

"Lenders often rely on the middle score between the highest and lowest when evaluating creditworthiness, offering a more reliable indicator."

Minimum Credit Score Requirements by Loan Type

When you want a mortgage, knowing the credit score needs is key. These needs change based on the loan type. Knowing these scores helps you see if you qualify and get ready for the application.

Conventional mortgages, which are common, need a FICO® Score of 620 to 660. You also need a 3% down payment and a DTI of 45% to 50%. But, some lenders like New American Funding might accept scores as low as 580.

FHA loans need a 580 score for a 3.5% down payment. Or, you can get one with a 500 score if you put down 10%. LoanDepot offers FHA loans starting at 500 for a 10% down payment and 580 for 3.5%.

VA loans don't have a minimum score, but most lenders want a 670 or higher. USDA loans usually need a 640 score.

Jumbo loans, for bigger amounts, need a 700 to 720 score. You also need a 10% down payment and a DTI of 36%.

| Loan Type | Minimum Credit Score |

|---|---|

| Conventional | 620 - 660 |

| FHA | 500 - 580 |

| VA | No set minimum, often 670+ |

| USDA | 640 |

| Jumbo | 700 - 720 |

Remember, these are general rules. Lenders can have their own score needs. Knowing these can help you get a mortgage and get good terms.

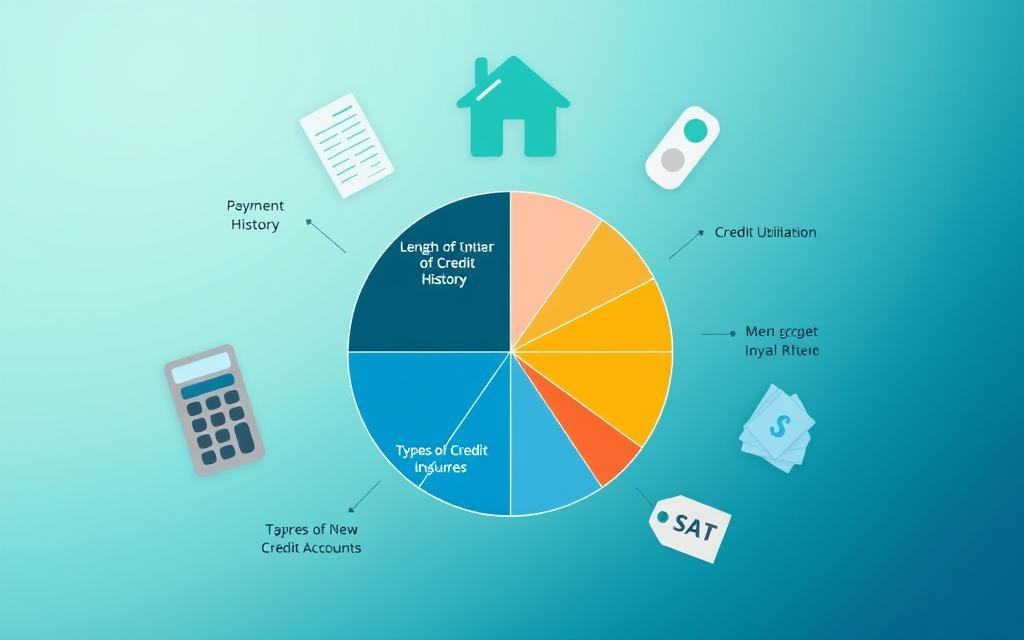

Credit Score for Mortgage: Key Factors That Shape Your Score

Your credit score is key when you want a mortgage. It affects if you can get a loan and what it will cost. Knowing what makes up your score can help you improve it. This can make it easier to get a mortgage.

Payment History Impact

Payment history is the biggest part of your score, making up 35%. Lenders look for a history of on-time payments. This shows you can handle debt well. One late payment can lower your score, so pay bills on time.

Credit Utilization Ratio

How much credit you use is also important. Try to use less than 30% of your available credit. Using too much can hurt your score and mortgage chances.

Length of Credit History

How long you've had credit matters too. Longer histories are seen as better. Don't close old credit cards, even if you don't use them.

Knowing these factors and keeping your credit healthy can help. It makes the mortgage process easier and can get you better loan terms.

"A good credit score is crucial for the best mortgage deals. Focus on your payment history, credit use, and how long you've had credit. This way, you can improve your score and reach your dream of owning a home."

The Role of Credit Scores in Interest Rate Determination

Your credit score plays a big role in the interest rate you get on a mortgage. The higher your score, the lower the interest rate. A score of 740 or above usually gets you the best rates.

Even a small change in interest rates can make a big difference. It affects your monthly payments and the total interest you pay over time.

Lenders look at your credit score to decide if they should lend to you. A higher score means less risk, leading to better loan terms. But, a lower score might mean a higher rate because you're seen as a higher-risk borrower.

Knowing how your credit score affects mortgage rates helps you make better choices when buying a home.

| Credit Score Range | Typical Mortgage Interest Rate* |

|---|---|

| 760-850 | 4.5% |

| 700-759 | 4.75% |

| 640-699 | 5.25% |

| 580-639 | 5.75% |

| 500-579 | 6.25% |

*Rates are for illustrative purposes only and may vary based on market conditions, loan type, and other factors.

Knowing how your credit score affects mortgage rates lets you work on improving it. This can save you thousands over the loan's life. Check your credit report often and fix any mistakes to keep your score high.

"A strong credit score is your key to unlocking the most favorable mortgage rates and terms. By understanding how lenders evaluate your creditworthiness, you can take proactive steps to optimize your financial profile and achieve your homeowning dreams."

Government-Backed Loans vs Conventional Mortgages: Credit Requirements

Borrowers can choose between government-backed loans and conventional mortgages. The credit score needed varies between these options.

FHA Loan Credit Requirements

FHA loans are backed by the Federal Housing Administration. They have flexible credit score needs. You can get an FHA loan with a score as low as 500, needing a 10% down payment.

If your score is 580 or higher, you only need a 3.5% down payment. This is great for first-time buyers or those with less money for a down payment.

VA and USDA Loan Considerations

There are other government-backed loans too. VA loans are for military members and veterans. They don't have a minimum credit score.

USDA loans are for low-income people in rural areas. They usually need a score of 640.

Conventional Loan Standards

Conventional mortgages have stricter credit score needs. Most lenders want a score of 620. Scores above 740 get the best rates and terms.

Conventional loans often require a 5% down payment. A 20% down payment can help avoid Private Mortgage Insurance (PMI).

In short, government-backed loans are more flexible with credit scores. This makes them easier to get. But, conventional mortgages need higher scores. They can offer lower interest rates and avoid PMI over time.

Strategies to Improve Your Credit Score Before Applying

Your credit score is key when you're looking to get a mortgage. A better score means you might get lower interest rates and better loan terms. There are ways to improve your score before you apply for a mortgage. Let's look at some effective steps to help you prepare.

- Pay your bills on time: Your payment history is a big part of your credit score. Paying all your bills, like credit card bills and utilities, on time can help your score.

- Reduce your credit card balances: How much debt you have compared to your credit limit is important. Try to keep your credit card balances low, below 30% of your limit.

- Become an authorized user: If someone you know has a good credit card, ask to be an authorized user. This can help improve your credit history and score.

- Check your credit reports for errors: Look at your credit reports from Experian, Equifax, and TransUnion often. If you find mistakes, get them fixed. This can also improve your score.

Improving your credit score takes time, so start early. By following these tips, you can improve your score and prepare for a better mortgage experience.

"A higher credit score can lead to lower interest rates and better loan terms when applying for a mortgage."

By working on your credit and using these strategies, you can build a stronger credit profile. This will help you get approved for a mortgage with better terms.

Beyond Credit Scores: Additional Mortgage Approval Factors

Getting a mortgage is more than just your credit score. Lenders look at many factors to decide if you qualify and what terms you'll get. Let's look at what else matters when buying a home.

Debt-to-Income Ratio Requirements

Lenders check your debt-to-income (DTI) ratio. This is how much you pay each month in debt compared to your income. They want this ratio to be 50% or less. A higher DTI can mean trouble, like denied loans or higher interest rates.

Employment History Verification

Having a steady job is key for getting a mortgage. Lenders like to see at least two years of stable income. If you've changed jobs or have an unusual income, you might need to prove you can pay back the loan.

Down Payment Considerations

The size of your down payment matters too. The amount needed varies by loan type. For example, VA and USDA loans might need no down payment, while conventional loans might require 3-20%. A bigger down payment can show you're ready to buy and might get you better loan terms.

Mortgage approval is a detailed look at your finances. Knowing what else lenders check can help you get ready for buying a home.

| Loan Type | Minimum Credit Score | Minimum Down Payment |

|---|---|---|

| Conventional | 620 | 3-20% |

| FHA | 500-580 | 3.5% |

| VA | No minimum | 0% |

| USDA | No minimum | 0% |

"Tighter lending standards since the subprime mortgage crisis of 2008 have resulted in increased scrutiny of borrower's income, credit history, credit scores, and assets by mortgage lenders."

The Impact of Multiple Credit Inquiries During Mortgage Shopping

When you're looking for a mortgage, it's common to compare rates and terms. But, did you know that too many credit checks can hurt your score? We'll look at how these checks can affect your mortgage and how to lessen their impact.

FICO, the top credit scoring model, gives you a 45-day break for mortgage inquiries. This means all hard checks in this time count as one, not many. This is good for those mortgage rate shopping, as you can check out different lenders without hurting your credit inquiries too much.

- Hard inquiries, like those from mortgage apps, can slightly lower your score, by less than five points.

- Many hard inquiries in a short time can hurt your score more, as lenders might think you're applying for lots of loans.

- Soft inquiries, like prequalification checks or checking your score yourself, don't affect your score.

To avoid hurting your credit inquiries while mortgage rate shopping, try to do all your comparisons in 45 days. This way, the credit bureaus will see all inquiries as one, which won't hurt your score as much.

Knowing how credit inquiries work and using the FICO grace period can help you find great mortgage rates without harming your credit score. Always keep an eye on your credit report to keep your credit healthy.

Documentation Required for Credit Score Verification

When you apply for a mortgage, lenders check your financial history and credit score. They need many documents to verify your application. This includes bank statements, pay stubs, tax returns, and explanations for any bad credit items.

Being ready with the right documents makes the mortgage application smoother. Here's what you'll need:

- Recent bank statements (usually the last 2-3 months)

- Pay stubs from the last 30 days

- W-2 forms for the last 2 years

- Federal tax returns for the last 2 years

- Any extra income sources, like 1099 forms or business tax returns (for self-employed)

- Explanations for any negative items on your credit report, like late payments or collections

Keeping your financial records organized helps a lot. It shows you're ready for the mortgage process. Being prepared with all the necessary documents speeds up the credit check. This is a big step towards owning your own home.

"Providing complete and accurate documentation can expedite the mortgage approval process."

Maintaining Good Credit After Mortgage Approval

As we near the end of the mortgage process, keeping good credit is key until closing. Avoid new credit accounts, big purchases, or job changes. Lenders might check our credit again before closing. Big changes could risk the loan approval.

It's vital to keep practicing good credit habits. This ensures a smooth closing and better loan terms.

After getting mortgage approval, managing our credit is crucial. Keep credit card balances low and pay on time. Avoid big financial decisions that could hurt our credit.

By keeping a strong credit profile, we show the lender we're reliable. This increases our chances of a successful closing.

The post-approval credit management period is as important as the preapproval. Stay vigilant and follow good credit practices. This protects our credit score and gets us the best mortgage terms. It makes buying a home easier and more rewarding.

If you want to know other articles similar to Credit Score for Mortgage Approval: What Lenders Look For You can visit the category Mortgage.

Deja una respuesta